Introduction

Payments have never been easier than today. We’ve progressed from frantically searching the bottom of our bags for any cash. Today, we simply tap our card at a point of sale. Convenience remains the main focus shaping the future of payment technology, so its trends and alternatives are likely to expand further.

Keeping pace with emerging payment trends allows merchants to keep consumers satisfied, remain up to date with security improvements, and minimize processing errors. So, what’s next for payment trends? Let’s look at what to expect in 2024.

What are the Trends in the Payment Industry?

Payment Methods

Mobile Payments

Mobile payments are poised to remain a dominant force in the payments industry for years to come. They’ve emerged as the most popular new payment method in recent years, with the U.S. market alone reaching an estimated value of $53.5 billion in 2022. This trend is expected to continue, with projections suggesting a rise to over $607.9 billion by 2030. The beauty of mobile payments lies in their accessibility. They allow businesses of all sizes to reach customers wherever they are. Additionally, processing payments becomes a breeze with a point-of-sale system. It enables transactions through tablets, smartphones, or even smartwatches.

Beyond the contactless convenience, the biggest perk of mobile payments is their speed. The ease and rapidity of the transaction benefit both the customer and the retailer. There is no need to insert a card, enter details, or wait for change.

Embedded Payment Systems

Embedded payment systems allow buying things without leaving the app or website the customer is using at the moment. Such systems create a smooth, one-click checkout experience for users. They don’t need to be redirected to a separate payment portal. The simplicity of embedded payments reduces friction and potentially boosts sales for businesses.

Here’s a breakdown of why embedded payments are gaining traction:

- Enhanced user experience. Customers can pay within the platform they’re already using. This makes the payment process faster and more convenient for users.

- Reduced cart abandonment. Friction at checkout can lead to customers abandoning their carts. Embedded payments eliminate this friction and can potentially increase sales.

- Scalability for businesses. Platforms can handle transactions directly, which allows businesses to grow and cater to a wider audience. Direct transaction handling reduces worries about integrating multiple payment gateways.

Embedded payments offer a win-win for both businesses and consumers. Businesses can improve customer satisfaction and increase sales. Meanwhile, consumers benefit from a faster and more convenient payment experience.

More and more platforms adopt this approach. Thanks to that, we can expect embedded payments to become an even more prominent trend in the future.

P2P (Peer to Peer) Payment Apps

P2P payment apps have gained so much popularity that the peer-to-peer money transfer sector is now estimated at $2.95 billion. This market is expected to grow to $ 3.4 billion in 2024 and $6.4 billion in 2028, with a CAGR of 17.2%.

Aside from the well-known advantages of peer-to-peer payment apps, here are some more pros you should be aware of:

- You can pay without using cash, which allows you to complete purchases even if you forgot your wallet at home;

- Most peer-to-peer payment applications are free to use;

- Some services have little to no transaction, processing, or service costs;

- Some P2P payment services provide better currency exchange rates than banks or traditional transfer systems;

- P2P networks use encryption and have fraud detection capabilities, which ensures that every transaction is secure;

- Depending on the platform, P2P transactions can provide some level of anonymity.

Buy Now Pay Later (BNPL)

Buy Now, Pay Later (BNPL) is also known as a “point-of-sale loan”. It is a short-term loan that enables you to purchase products or services and then make payments in several iterations determined by an online application vendor or a store. BNPL is offered by Klarna, Afterpay, Affirm, PayPal, and others who partner with retailers and e-commerce platforms.

A 2022 Juniper Research study estimated that the number of BNPL users would exceed 900 million globally by 2027. The number of users was 360 million in 2022, representing a 157% rise. At that time, Lafferty’s research showed that the market size of BNPL is expected to reach $532.9 billion in 2024.

Adding BNPL into an existing application typically involves the API integration with BNPL providers. But don’t forget to take care of robust user authentication in your app for transaction approval and activate automated reminders for timely payments.

Social Commerce Payments

In 2023, social commerce gained revenue of $571 billion. Having a CAGR of 13.7% to 2028, it is expected to reach $1 trillion in the next few years.

Nowadays, businesses can create shops on Facebook, TikTok, and Instagram where customers can directly purchase things. TikTok Shop was just opened in the United States in 2023, and we don’t anticipate it to go away. As more people utilize these apps, businesses will have additional opportunities to sell their products and generate new money.

That’s why it could be beneficial for businesses to start accepting payments on these apps.

Payments in Crypto

Cryptocurrencies are becoming more widely accepted as a form of payment. The companies eliminate any questions or worries that merchants may have about cryptocurrency, allowing them to provide more payment options.

For these reasons, you should understand the benefits and drawbacks of payment gateways.

Benefits:

- A payment gateway removes the anonymity of who you’re dealing with while maintaining your customer’s preferences;

- You have a contact person for any payment concerns;

- You can get money from anywhere in the world using any cryptocurrency that the provider accepts;

- You receive money in an account with your provider, and the provider transfers it to you;

- You don’t need to bother about or try to grasp cryptocurrency;

- It reduces the risk of losing value while waiting for a transaction to be verified. It compensates you with the market rate for the tokens at the time the transaction was completed.

Drawbacks:

- A payment gateway is a third party that cryptocurrencies were initially intended to avoid;

- You must rely on the provider’s capacity to deliver service at all times. You may receive payments from all over the world and in various time zones;

- Gateways are organizations providing a service. So they’ll sell themselves in a form that makes it look like you need their services when you truly don’t;

- When you use your wallet, the transaction fees are lower than with a payment gateway;

- If the payment gateway is compromised, you will lose any money in your account with the supplier while you wait for them to be moved.

To integrate a crypto payment gateway, you need to decide which cryptocurrencies you want to accept (Bitcoin, Ethereum, etc.), compare a few processors and their fees, and check the integration options (plugins, API, hosted pages) for your platform. Besides, you’ll need a crypto wallet to receive and store the cryptocurrency payments.

Trends in Payment Authentication Methods

Biometric payment is one of the trends in the payment industry. It’s a POS technology that employs biometric authentication based on physiological characteristics. It’s applied to identify the user and authorize the withdrawal of money from a bank account.

Fingerprint recognition

More and more mobile wallets use the technology of fingerprint recognition to increase security and convenience for in-store payments. With the growing popularity of such wallets, this trend is likely to continue.

Facial Recognition

Similar to fingerprints, facial recognition offers a smooth payment experience. Facial recognition technology can be implemented into any device that has a camera: smartphones, tablets, kiosks, and even vending machines. This creates a convenient payment experience across a wide range of devices.

While facial recognition is generally secure, there’s always a risk of spoofing attempts using photos or masks. Advancements in liveness detection are needed to mitigate these risks.

Iris Scanning

Iris scanning has great potential to become a future trend in payment authentication. Still, the possibilities of its adoption are quite limited, compared to facial or fingerprint recognition.

Unlike fingerprints or faces, the iris is covered by an eyelid, preventing it from forging or copying. This offers a big security advantage over other biometrics methods. However, despite its security, iris scanning is not yet widely adopted. And, compared to other biometric methods, iris scanning implementation can be more expensive. This can become an issue for such identification in the future.

The potential of iris scanning lies in a faster, more user-friendly, and, potentially, more affordable identification process, as well as in the possibility of combination with other biometric methods to create a more secure system.

Trends in Payment Technology and Infrastructure

Real-Time Payments

Real-time payments are expected to become more popular in 2024.

A real-time payment is an instant movement of money from one bank account to another. Instead of the usual 1 to 3 days, there is no waiting time. Payment confirmation comes in real time. It allows the customer to see a payment in their account instantly.

This is a game changer for companies that don’t want to wait for settlement funds. Instead, they receive their money daily in their accounts. Examples of real-time payment applications are PayPal, Venmo, Interac e-Transfer, and more.

Your can integrate real-time payment apps into an online store for an instant checkout experience. Or use them to offer instant payouts to contractors, gig workers, or service providers through your system.

Open Banking Solutions

Open banking allows users to securely share their banking data with external organizations through APIs. Key providers include Visa, Mastercard, Symcor, Sopra Banking Software, and various fintech companies.

Any software company can potentially integrate open banking APIs into its products. Of course, it has to consider region-specific regulations like PSD2 in Europe or the Consumer Data Right in Australia. Then, the company needs to establish partnerships with banks, credit unions, and fintechs to gain access to their open banking APIs and obtain necessary support for integration.

The company must be able to securely handle sensitive customer data, following security and privacy guidelines. This may involve implementing encryption, authentication, authorization mechanisms, and following API standards like the Berlin Group Framework.

Central Bank Digital Currency (CBDC)

CBDCs are digital currencies issued by central banks. Their value is determined by the official currency of the country that issued them.

There is no common form of CBDC. A wide range of ways are being tested in different countries. One sort of CBDC is an account-based approach like DCash, which is used in the Eastern Caribbean. DCash allows individuals to hold deposit accounts that connect them to the central bank. On the other side of the spectrum is China’s e-CNY. It’s a CBDC experimentation that relies on private-sector banks to distribute and handle digital currency accounts for their users.

Currently, 119 countries are developing CBDCs.

There are four trends that are likely to drive central banks’ interest in CBDCs:

- Cash usage in Europe fell by one-third between 2014 and 2021. In Norway, barely 3% of payment transactions are performed in cash. This tendency has prompted central banks to reconsider their position in the monetary system.

- There is an increasing demand for privately owned digital assets. According to the European Central Bank, up to 10% of households in 6 main EU nations possess digital assets. Consumer use of digital assets has the potential to undermine fiat currency as a unit of value measurement.

- Central banks are losing their reputation as payment pioneers. CBDCs provide central banks with a unique opportunity to conduct strategic discussions about cash use cases in a public arena.

- Global payment systems are on the rise. Many central banks want to create more local control over increasingly global payment systems. Central banks regard CBDC as a possible stabilizing force for local digital payment systems.

Fraud Management Services

Fraud management services are a very important trend in the payment industry. These services can help find and prevent fraudster’s actions to save financial losses. They also create a secure payment environment that is crucial for building trust with clients.

Fraud management services analyze transaction data in real time by using complex tools. For example, they can use advanced algorithms to find suspicious patterns, such as unusual spending habits, various billing addresses, or transactions from high-risk locations.

This leads to immediate intervention to block fraudulent attempts, ensuring the process’s security.

Fraud management services are becoming highly complex, using artificial intelligence to stay relevant. These technologies empower fraud management systems to continuously learn and adapt to fraudster attempts. This allows systems to identify even the smallest anomalies, reducing the chances of successful fraud attacks.

Many regulations require businesses to implement robust security measures to protect customer data. Fraud management services can help businesses to comply with these regulations.

Different types of fraud management services include transaction monitoring, identity verification, fraud scoring, and more.

The future of fraud management services lies in continuous improvement. As fraudsters develop new tactics, these services will need to become even more advanced and leverage modern technologies like AI and big data analytics.

Payment Industry Tips & Tricks

How to Achieve Premium Customer Experience in Digital Payments

Customer experience has become the top focus for businesses. Businesses now understand that all of their efforts will be in vain if their brand’s customer experience is poor.

But what exactly do we mean by “customer experience?” It includes managing interaction across digital platforms, physical stores, phones, and, of course, any business partners via which customers interact with the brand. Businesses genuinely understand this and strive to be experience-driven businesses (EDBs). They consider contact points across the people, process, and technology pillars.

Shift To Customer-Driven Business

Customers now have more options than ever before in an increasingly digitized world. It’s now incredibly simple to switch brands and providers. This means businesses must work harder to keep their customers satisfied.

The main point here is that the customer experience is one of the most critical factors in developing a successful business. The good news is that customers don’t only react negatively to unpleasant interactions. They also react positively to excellent ones. If done correctly, you may create a base of loyal clients prepared to pay more for your service.

Invisibility of Payments

Speed is an important component of any user experience, and in payments, it often boils down to ease of use.

Payments should be almost undetectable throughout the procedure. This implies as minimal interventions as possible. A seamless future in payments will be led by three essential principles: simplicity, seamlessness, and scalability. Customers want a smooth, seamless experience. It should allow them to purchase products or services with minimal effort and maximum convenience.

Management of Liquidity

Real-time payment data help small and medium-sized firms in better planning of their supplier payments. That way they improve their total cash and liquidity situation.

For example, payment insights can assist firms in understanding a potential rise in credit days and payment delays. This allows them to better control their vendor’s payments and liquidity.

Scalability of Payments

Another important moment is flexibility. The money and spending habits of customers are becoming more complex. People are changing their single bank accounts to the best fintech options to fulfill their needs. To be on top of the competition, businesses have to make effective collaborations with others and provide the best services.

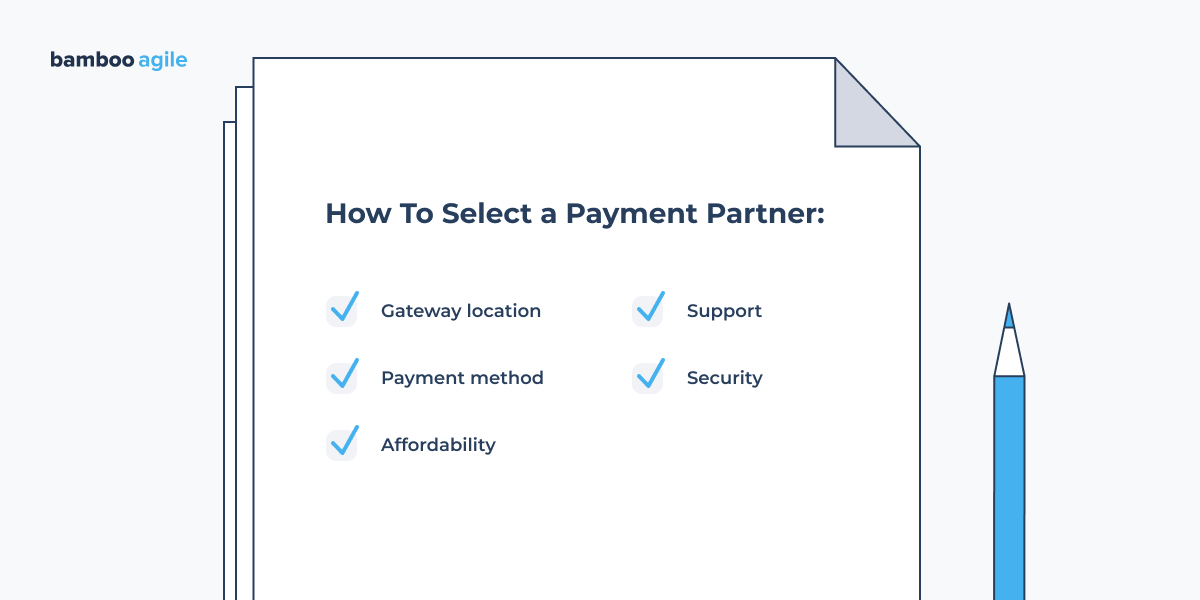

How to Select a Payment Partner

Choosing the right payment partner for your custom software development is critical. Given the wide range of possibilities available, here are a few things to think about.

Gateway Location

Before selecting a payment vendor, you should evaluate the vendor’s geographic region. Is the supplier licensed to carry out business in your country? Can your target audience use these payment vendors without difficulty?

You should also consider the supported currencies, conversion rates, and payout frequency. Many firms serve customers from all over the world. That’s why the payment processor should be able to convert funds into local currency.

Payment Method

You have to carefully consider payment methods when choosing a payment gateway. Most clients pay with their credit and debit cards.

However, the payment partner’s services should not be limited to the most common payment methods. They should accept more modern types of payment, such as net banking, e-wallets, vouchers, and others. The big plus is when the vendor offers clients to select a payment method based on their preferences.

Cryptocurrency is also becoming popular as a form of payment, so make sure to ask a vendor if they accept major cryptocurrencies.

Affordability

You have to prioritize affordability when choosing a payment gateway. Look for a payment partner who offers a competitive fee structure. Remember, the most affordable option isn’t always the best. There is a balance between cost and the features offered by the vendor.

When estimating costs, be sure to consider any transaction volume limitations. Exceeding these limits can result in additional late fees. Carefully review the fee structure and avoid hidden costs. This way you can ensure a cost-effective payment solution for your business.

Support

Before choosing a vendor, consider factors that influence the overall user experience. A smooth checkout process is crucial. Customers expect a streamlined experience with minimal steps, clear instructions, and fast loading times. Any difficulties can lead to cart abandonment.

Look at providers who offer a user-friendly interface and prioritize customer satisfaction. This includes offering effective solutions to customer support issues. When customers are facing problems, a prompt and helpful response can turn a negative experience into a positive one.

Security

Security is a big concern when choosing a payment partner. As a result, the gateway you’re using to store financial data and process payments should be PCI-DSS (Payment Card Industry Data Security Standard) compliant. It should also provide OTP, fraud detection, embeddable checkout, and payment screening.

A reliable payment partner should also worry about risk management and mitigation. They should also be in charge of other areas of payment processing, such as automatic payments, cross-platform assistance, and issue resolution.

Have a look at our recent article on fintech app development approach.

New Standards & Regulations for Payment Systems

Payment systems standards and regulations play a critical role in ensuring a smooth, secure, and fair environment for digital payments.

Technical Standards

Technical standards are the technical specifications for how payment systems communicate and exchange data. ISO 20022 (messaging format for financial data) and EMV (chip card technology) are great examples. These standards ensure interoperability between different payment systems, devices, and networks.

The ISO 20022 standard isn’t new, but there were significant updates to the messaging format within the last 5 years. These updates are targeted to improve efficiency and transparency during payment transactions.

Security Standards

Security standards focus on the protection of sensitive data and fraud prevention. A great example is the PCI-DSS. It sets security requirements for organizations that handle cardholder information.

Consumer Protection Regulations

These regulations aim to protect consumers from frauds and unauthorized transactions. PSD2 (Payment Services Directive 2) is an example in Europe. It mandates strong customer authentication (SCA) for certain online transactions.

SCA requires additional verification steps beyond just a password, such as fingerprint recognition or a one-time code, to improve security and prevent fraud.

Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations

These regulations help prevent money laundering and terrorist financing. They require businesses to verify the identity of their customers and monitor transactions for suspicious activity.

Data Privacy Regulations

These regulations manage the collection, storage, and use of customer data within the payment ecosystem. An example is GDPR (General Data Protection Regulation). It gives people control over their data. The regulations impact how payment service providers collect, store, and use customer data, requiring stricter data protection measures.

Open Banking Regulations

Various regulations around Open Banking have been introduced or expanded in recent years. As was mentioned above, open banking allows third-party providers to access customer financial data with consent, fostering innovation and competition within the financial services sector.

What Lays Ahead – Conclusion

Payment processing trends have a huge impact on how businesses operate and connect with customers.

We continue to navigate the digital age. That’s why blockchain technology, mobile payments, cashless payments, and fraud detection are among the top improvements that transform the payment processing sector.

The desire to catch a wave of a fast-evolving payment industry can’t be surprising. However, you have to be very cautious while choosing the development partner. Bamboo Agile offers financial & insurance software development services aligned with the outstanding expertise of its developers. It can become a great partner in your payment services development journey.