Introduction

Digital wallets have become increasingly popular in recent years, especially with the growing use of mobile devices and the internet. They offer numerous benefits to both consumers and businesses, including faster transactions, lower costs, improved security, and greater convenience.

This article will answer the questions of:

- What is a digital wallet?

- Why launch one?

- What kinds of wallets are there?

- How to create a digital wallet?

- How to ensure it’s secure?

- and everything else you need to know about e-wallets.

Let’s get right into it.

What Is a Digital Wallet?

A digital wallet (a.k.a. an e-wallet) is a software solution that lets you keep, manage, and transfer money with just your phone, tablet, or computer. It also allows you to manage all kinds of digital assets, including crypto, bank accounts, cards, and so on.

Here’s how it works. You submit your payment information and personal data for the wallet to remember. So when you make purchases, you won’t need to enter any of it again. All you need to do is select the appropriate payment option and confirm the transaction with a password, fingerprint, or other authentication method.

The whole process takes only a couple seconds.

Benefits of Launching a Digital Wallet App

Launching an e-wallet app can offer several benefits to businesses, including increased customer loyalty, improved data protection, and enhanced user experience. Here are some advantages of launching a digital wallet:

Improved Security

Software-based wallets provide an additional layer of security by encrypting payment information and using tokenization to mask sensitive data. This reduces the risk of fraud and data breaches, making digital wallet transactions safer than traditional payment methods.

Example: Apple Pay requires users to authenticate transactions with Touch ID or Face ID, and their payment information safely stored in the iPhone’s Secure Element.

Customer Loyalty

The software can help businesses build stronger relationships with their customers by providing convenient and seamless payment experiences. This leads to increased customer satisfaction and repeat purchases.

Example: Starbucks’ mobile wallet app has been hugely successful in building customer loyalty. The app allowed users to easily pay for their coffee and earn rewards points, as well as make orders in advance and skip the queue.

Greater Convenience

Wallet apps allow users to keep all their payment information in one place, making it easier and faster to complete transactions. They also eliminate the need to carry physical payment cards or cash.

Example: PayPal offers users the ability to make purchases online, send and receive money, and even pay at participating merchants using QR codes.

Reduced Transaction Costs

Digital wallets can help businesses reduce the costs associated with processing payments, such as transaction fees and chargebacks.

Example: Cash App allows users to send and receive money for free, and charges businesses a lower transaction fee than traditional payment processors.

Enhanced User Experience

Wallet solutions offer more seamless and intuitive experience than traditional payment methods, improving customer retention and reducing cart abandonment rates.

Example: Google Pay provides users with a simple and intuitive payment experience. It lets them make purchases, as well as send and request money using their mobile devices.

FinTech Industry Trends 2023

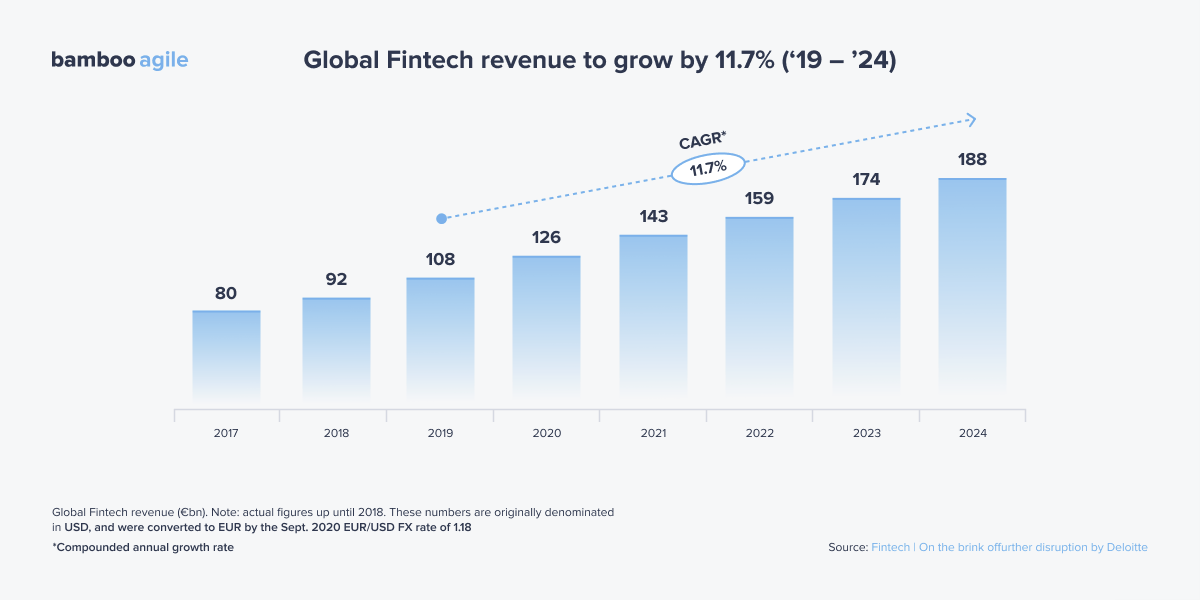

Fintech is consistently expanding. According to Deloitte, the industry will reach $174 billion in 2023 and $188 billion by 2024.

As far as technology goes, the biggest Fintech trends today are:

- AI & Machine Learning. Fintech companies employ AI and ML to automate loan origination, fraud protection, customer analytics, data analysis, and many other processes.

- SaaS. SaaS services are cloud-based solutions that help fintech companies reduce overheads. They also provide powerful security tools and protocols for safe data storage and management.

- IoT. IoT sensors can be utilised for gathering customer data and automating certain activities based on it, e.g. fraud detection and automatic payments. They’re also widely used for biometric authentication.

- Blockchain. Blockchain is growing in popularity among fintech businesses, and it’s not just because of added transparency and security. The technology lets them cut costs on intermediaries (banks, brokers) due to its distributed nature.

- Open banking. Open banking lets customers securely share their financial data with third parties and allows the latter to access said data whenever necessary.

- Embedded Finance. This is a broad term for different payment services that can be added as features to apps, websites, and frameworks. “Buy Now Pay Later” functionality is a very popular example of that.

- Digital Wallets. An increasing number of companies offer smart wallet services. This includes tech firms, payment processors, and financial institutions. Popular examples include PayPal, Venmo, Google Pay, etc.

Mind you, all the technologies listed above are designed with digital wallets in mind. They are much easier to integrate with new tech by virtue of being software products.

Types of Digital Wallets and Their Pros and Cons

High-tech wallets can be split into three categories.

Mobile Wallets

Mobile wallets are applications that can be downloaded onto a smartphone or tablet. Well-known examples of mobile e-wallets include Apple Pay and Google Pay. These offer convenience, accessibility, and ease of use, but they also come with some potential drawbacks.

Pros:

- Convenience. Mobile wallets are designed to be used on-the-go, making them incredibly convenient. Users can pay for goods and services with just a few taps on their smartphone, eliminating the need to carry cash or credit cards.

- Accessibility. Mobile wallets are available to anyone with a smartphone or tablet, making them accessible to a wide range of consumers. They are particularly popular among younger generations who prefer to manage their finances digitally.

- Ease of use. Mobile wallets are typically very user-friendly, with intuitive interfaces and straightforward payment processes. This makes them easy for consumers to use, even if they have limited experience with digital finance.

Cons:

- Safety risks. Mobile wallets are susceptible to a range of security risks, including hacking, phishing, and malware. If a user’s phone is lost or stolen, their wallet could be compromised, putting their personal data at risk.

- Compatibility issues. Mobile wallets may not be compatible with all merchants or payment systems, which can limit their usefulness in certain situations. Additionally, some mobile wallets require a specific type of phone or operating system. This can exclude users who do not meet these requirements.

- Limited functionality. Mobile wallets may not offer the same level of functionality as other types of wallets. This is particularly noticeable when it comes to cryptocurrencies.

Check out our e-Wallet project for iOS and Android as an example of a simple, yet effective mobile wallet.

Desktop Wallets

Desktop wallets are installed on a user’s computer. Electrum and Exodus are popular examples of ones that work with cryptocurrency. This type of wallet boasts superior security and functionality, but may also be less convenient than mobile wallets.

Pros:

- Security. Desktop wallets are generally considered more secure than mobile wallets, as they are not as susceptible to hacking or malware. They also offer users greater control over their private keys, which can be used to safeguard their digital assets.

- Functionality. Desktop wallets often offer more advanced functionality than mobile wallets, especially when working with crypto. They may offer features such as multi-sig support, coin mixing, and cold storage.

- Customizability. Desktop wallets can be customised to suit a user’s specific needs and preferences, allowing them to choose the functionality and settings that suit them best.

Cons:

- Limited accessibility. Desktop wallets can only be accessed from a single computer, making them less available than mobile wallets. This can be inconvenient for users who need to manage their finances from multiple devices.

- Complexity. Desktop wallets can be more complex and difficult to use than mobile wallets, especially for users who are not familiar with digital finance. They may require some technical knowledge to set up and use effectively.

- Vulnerability to hardware failures. Desktop wallets are vulnerable to hardware failures, which can result in the loss of private user keys and digital assets.

Hardware Wallets

Hardware wallets are physical devices that keep private keys and digital assets offline, offering the highest level of protection among digital wallets. However, they may also be less convenient and more expensive than other types of e-wallets. The most popular hardware wallet brands today are Ledger and Trezor, which offer crypto wallet functionality.

Pros:

- Data protection. Hardware wallets keep all the assets and user data offline, away from potential hacking or malware attacks. They are also resistant to physical damage, such as water and fire.

- Control. Hardware wallets give users complete control over their information and digital assets with minimal third-party involvement.

- Compatibility. Hardware wallets are compatible with a wide range of cryptocurrencies, making them a versatile option for users who hold multiple digital assets.

Cons:

- Cost. Hardware wallets can be more expensive than other types of wallets, with prices ranging from around $50 to $200 or more. This can be a barrier for some users.

- Inconvenience. Hardware wallets are less convenient than desktop or mobile wallets, as they require a physical device to access funds. Users must also ensure that their device is kept in a safe place and is not lost or stolen.

- Limited functionality. Hardware wallets may not offer the same level of functionality as other types of digital wallets. They may require additional software or tools to access certain features.

How to Create a Digital Wallet: a Step-by-Step Guide

Now let’s talk about how e-wallet software is made. Financial app development can seem like a daunting task, but by following these steps, you can ensure a successful launch of your e-wallet app.

Define Key Features

Before you start creating your wallet software, you need to define the key features you want to include. Some of the essentials are:

- Secure user authentication

- Ability to store multiple types of cryptocurrencies

- Support for popular cryptocurrencies such as Bitcoin, Ethereum, and Litecoin

- Easy-to-use interface for sending and receiving payments

- Multi-language support

- Backup and restore options

- 24/7 customer support

Here, research is essential. Hold surveys, interviews, and simply scout the internet for objective data to determine the state of the market and the demands of potential customers. Define the key features accordingly – you’ll ensure that your solution meets the core needs of its target audience.

Choose Platforms

Choosing the right platform is essential for the success of your wallet solution.

You need to decide whether you want to develop your app for iOS, Android, or both if you’re doing mobile; Windows, MacOS, or Linux, if you’re doing desktop. You can also consider developing a web-based app that can be accessed from any device with an internet connection.

In any case, always consider the target audience and the platform they are most likely to use. For example, if you’re targeting tech-savvy millennials, developing for iOS and Android might be the best option.

Choose the Right Technology and Framework

Choosing the right technology and framework is crucial for the development of your wallet app. Some popular technologies and frameworks for developing such applications include React Native, Swift, Java, and Kotlin.

“You don’t need a complicated stack. For instance, the e-Wallet mobile app we developed for iOS and Android used Node.js for the backend and Swift and Kotlin for the frontend,” says Alexey Shinkarev, the Engineering Manager at Bamboo Agile.

Of course, you should always consider the scalability of your app and whether the chosen technology can handle a large number of users and transactions.

Consider Integrations

Integrations with other platforms and services can add a lot of value to your digital wallet app. For example, you can integrate with popular cryptocurrency exchanges (Binance, Kraken, Coinbase), payment gateways (PayPal, Stripe, Amazon Pay), and merchant services to provide more functionality to your users: crypto trading, stock trading, gift cards, and more.

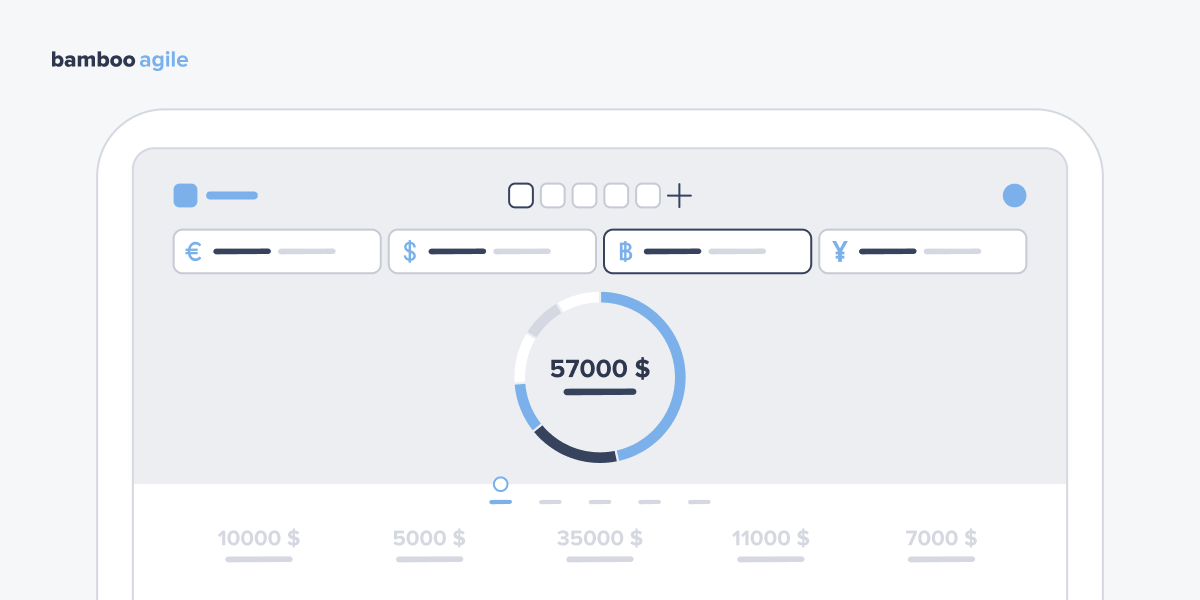

Design Your e-Wallet and Make a Prototype

Designing your e-wallet is a crucial step in the development process. You need to ensure that the user interface is easy to use and navigate even for non tech-savvy customers. Ideally, individual payments and transfers should not take more than a couple of seconds.

You can create a prototype of your app and see how the UI fares in action, as well as gather feedback from a focus group. Then your design and dev teams can implement changes based on the very first customer impressions before diving into full-on wallet app development.

Develop Your e-Wallet

Once you have designed your e-wallet and created a prototype, it’s time to kick off development. Consider making an MVP – a minimum viable product. MVP development is the practice of quickly building a product with a minimal feature set, which can be expanded after release. It’s a great tactic for reducing time to market and securing your initial user base.

Whether you are working on the software in-house of outsourcing development to an offshore team, you must maintain constant communication with the devs. Hold regular, preferably daily meetings with the team. Provide feedback and ideas, as well as updates and documentation. The team will provide valuable input and ideas in return, which will ultimately result in a stronger, more thought-out product.

Test

Testing your e-wallet is essential to ensure that it’s working correctly and meeting the needs of your users. Perform both functional and non-functional testing and ensure that the app is well protected and free of bugs.

Launch and Promote Your e-Wallet

The final step in creating a digital wallet is to launch and promote the app. To that end, you need to submit it to the relevant app marketplaces, such as the App Store and Google Play. While Google Play has very few publishing guidelines, Apple is much more strict. So ensure that your app meets all the necessary requirements before submission.

Once your wallet is launched, it’s high time to promote it to your target audience. You can do this through various marketing channels, such as social media, email marketing, content creators, and paid advertising.

Remember that you aren’t done once the app is all set and running. You have to continue to monitor and update the software to ensure that it meets the needs of your users and stays ahead of the competition long-term.

Securing Your Digital Wallet

Since fintech applications deal with sensitive financial information, it’s crucial for developers to prioritise data protection. Here’s how to make a digital wallet that is 100% secure:

1. Strong Encryption

One of the most critical security measures for financial apps is strong encryption. Encryption protects sensitive information by converting it into a code that can only be read by someone with the correct decryption key. To protect user data, developers employ strong encryption protocols such as AES-256 or RSA.

2. Multi-factor Authentication

To add an extra layer of protection, developers can implement multi-factor authentication (MFA) in the app. MFA requires users to provide two or more forms of identification, such as a password and a fingerprint scan, to access their account. This helps prevent unauthorised access to the user’s account even if their password is compromised.

3. Regular Updates

You should regularly update and patch the e-wallet solution to address any potential vulnerabilities. Don’t forget to conduct regular security audits and testing to identify potential loopholes.

4. Partnering with Reputable Security Providers

If you want to enhance the app’s protection even further, you can partner with trusted security providers (e.g. Bluefin, Forter, Onfido). These provide fraud detection, network security, and identity verification services.

Want to learn more about digital wallet security? Read this article.

FAQ

Conclusion

In conclusion, digital wallets have become a very popular payment method, providing a convenient and safe way for individuals to perform transactions online and in-person. While there are certain challenges to building and maintaining a wallet application, many successful industry examples prove it’s a worthy endeavour.

If you’re considering developing a custom e-wallet application, partner with an experienced vendor. Bamboo Agile can provide a team of experts with a rich background in fintech software development to help your project thrive. Contact us today to get a free consultation with our specialists.